This article explains the process for running your finances though the platform. It covers requirements, rating, validation, partner and advertiser billing and finally, finance as a service.

Every advertiser on your platform has a billing mode, which is defined in the financial settings. The billing mode defines whether and, if so, how an advertiser will be invoiced for traffic and conversions generated via the platform. Please consider the following

If you work with external advertisers and you want them to pay you in advance, use ‘prepayment’.

If you work with external advertisers and you do not want them to pay you in advance, choose from ‘postpayment direct’ or ‘postpayment standard’.

If you manage your own advertisers and you want to work with internal company billing, choose ‘self billing’.

If you manage your own advertisers and you do not want to work with internal company billing, choose ‘no billing’.

For further explanation, please read this article.

Financial templates are used to create deposits, invoices and payment entries used for advertiser and partner billing. They can be created and managed in the platform configuration. For more information about financial templates and comprehensive instructions on how to create them, please read this article.

The traffic the partners on your platform generate for your advertisers will result in conversions. A conversion can be a sale or a lead, but also a click-in or a video view, depending what you have defined as conversion targets. Depending on the commission model a partner is assigned to, conversions will be rated. When you are using the platform to manage external advertiser programs and you have defined a fee model for an advertiser, an advertiser fee will attributed to the conversion as well.

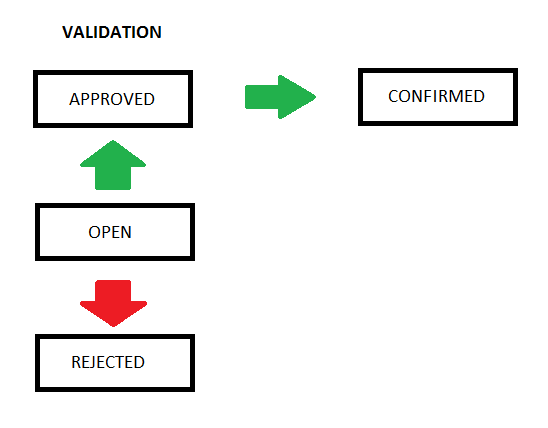

Conversions have to be validated, i.e. they have to be approved or canceled. This validation is necessary for various reasons: customers cancel orders, orders weren’t paid, partners use unauthorized advertising methods, etc. You process the validation by changing the status of a conversion. If a conversion is initially tracked, the status will be ‘open’. You can change this status either to ‘canceled’ or ‘approved’. If you approve a conversion, partners are entitled to receive the commission attributed to the conversion. As soon as you have approved your conversions, a final confirmation needs to follow. This confirmation will be managed by the platform automatically, following the billing mode of the advertiser for which the conversion was generated.

Please note that if basket tracking is applied, you do not validate the conversions directly. Instead, you validate the basket positions of a conversion. If all basket positions have been validated, the conversion will be validated automatically. For more information, please read this article.

There are basically three ways to manage the validation process:

Validating individual conversions manually. For comprehensive instructions, please read this article.

Validating conversions in bulk. For comprehensive instructions, please read this article.

Automated validation. For comprehensive instructions, please read this article.

If you validate your conversions in bulk or automatically, please note the status of a conversion corresponds with the following figures:

Open: 0

Approved: 1

Rejected: 2

Confirmed: 3

Partners will see the commission allocated to the conversions they generate in their reporting and on their dashboards. In both cases, it is labelled by status.

As soon as conversions have been confirmed, partners are entitled to receive the commission attributed to the conversions. Partners do not have to invoice you. Instead, the platform will create a so called self-billed invoice containing all the commission a partner has made within a certain period, usually within a month. In online marketing, these self-billed invoices are commonly referred to as payments, payouts or credit notes; in the context of this documentation, they are called payment entries.

The billing of partners via payment entries follows follows article 224 in the explanatory notes of the Invoicing Directive 2010/45/EU adopted by the European Union. According to this article, invoices may be drawn up by the customer in respect of the services supplied to him, by a taxable person, of goods or services, where there is a prior agreement between the two parties and provided that a procedure exists for the acceptance of each invoice by the taxable person supplying the goods or services. In the context of this platform, the customer is the entity, i.e. the legal body responsible for the payment of partners. The taxable person is either the partner or the partner’s company, the service supplied is generating conversions. The prior agreement are the terms and conditions partners accept when they register for the platform and apply for advertiser programs.

The billing of your partners consists of three main steps:

You generate previews of the payment entries that are available.

You create the actual documents.

You validate the payment entries. When they are created, the payment entries have the status ‘open’. When you validate, you change the status to ‘confirmed’ or ‘rejected’. After partners have received the commission to which they are entitled, the status of the payment entry is set to ‘paid’.

Please note partners will be notified as soon as a payment entry is confirmed. For comprehensive instructions, please read this article.

When it turns out a partner was not entitled to the commission paid, you can reverse a payment entry. When you do this, the amount in the payment entry will be substracted from any future commission paid to a partner. For more information, please read this paragraph.

If you want to dispatch your payment entries, you have the following options:

You can download individual payment entries in PDF.

You can dowload all the payment entries you created in one run in a joint PDF, in a SEPA file, in a CSV file and as a journal.

You can group payment entries by the month in which they were created, by entity, by status and by tax case and dowload them in CSV or a joint PDF.

How you need to bill your advertisers depends on the billing mode you choose. Consider the following:

When the billing mode of your advertiser is ‘postpayment direct’ or ‘postpayment standard’, you will have to create invoices. For comprehensive instructions, please read this article.

When the billing mode of your advertiser is ‘prepayment’, you will work with deposits. Deposits will be created automatically, when the threshold you defined. For more information, please read this paragraph.

When the billing mode of your advertiser is ‘self billing’ or ‘no billing’, the topic of advertiser billing is irrelevant.

The process of creating deposits and invoices follows the same steps as the creation of payment entries in the partner billing. First you generate previews, then you create the actual documents, you validate the documents by confirming or rejecting them and finally you mark them as paid.

The platform enables you to manage the banking involved in paying your partners and invoicing your advertisers. For more information, please read this article.